In the context of digital goods sales within the European Union (EU), our EU VAT Assistant for WooCommerce serves as a crucial tool for ensuring compliance with tax regulations. One pivotal aspect of this process involves the meticulous collection of proof of address for digital goods.

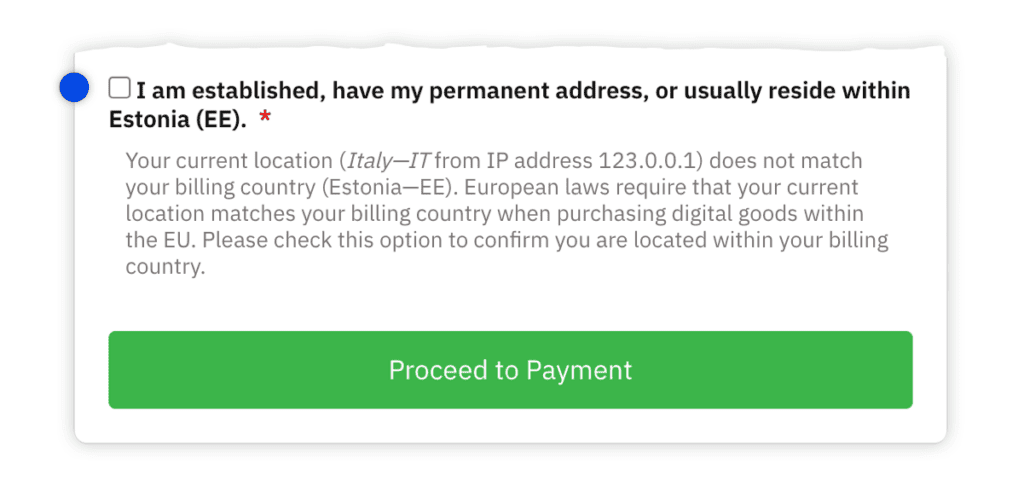

Seamlessly integrated into Fluid Checkout, our EU VAT Assistant add-on prompts customers to provide their billing address details, verifying that the billing country matches with their geolocation location based on their IP address and requiring manual confirmation when needed.

What are digital goods #

Digital goods refer to products or content that are delivered electronically, without a physical form. These goods are often consumed or experienced in a digital environment, such as on a computer, tablet, or mobile device. Examples of digital goods include:

- E-books: Digital books that can be downloaded and read on e-readers, tablets, or computers.

- Music: Digital music files, streaming services, or downloadable albums and singles.

- Software: Downloadable software programs, applications, or games.

- Videos and Movies: Digital movies, TV shows, or streaming services for on-demand viewing.

- Photographs and Images: Digital photos, stock photos, or digital art.

- Online Courses: Educational content delivered digitally, including video lectures, e-books, and other course materials.

- Subscription Services: Access to digital content or services on a recurring basis, such as streaming subscriptions for music, movies, or software.

- Apps and In-App Purchases: Mobile applications and digital purchases within those applications.

- Website Themes and Templates: Digital designs and templates for websites.

- Virtual Goods: Items or enhancements within online games, virtual worlds, or augmented reality experiences.

These examples highlight the diverse range of digital goods that can be bought, sold, or accessed in the digital marketplace. The sale and distribution of digital goods often involve considerations related to value-added tax (VAT) and other taxation rules, especially in cross-border transactions.

Significance of proof of address and manual confirmation for EU digital goods sales compliance #

For EU digital goods sales, securing proof of address and implementing manual confirmation is crucial for several reasons:

- Tax Precision: Ensures accurate tax jurisdiction assignment, aligning with varying EU member state rates.

- VAT Compliance: Verifies the customer’s location, ensuring adherence to specific VAT rates based on their country of residence.

- Legal Compliance: Meets legal requirements, especially in countries with stringent regulations regarding digital goods sales.

- Fraud Prevention: Adds a security layer to identify and prevent potentially fraudulent transactions.

- Record-keeping: Maintains a comprehensive audit trail for transactions, aiding in compliance verification during audits.

In essence, proof of address and manual confirmation are essential for precise taxation, regulatory compliance, and fraud prevention in EU digital goods transactions. Having all the proof of correctly handling VAT charges for digital goods can save you from fines and overpaying taxes.

Proof of address collected in accordance with the EU regulations #

In the context of selling digital goods within the EU, the requirements for proof of address may include:

- Billing Address Verification: Verification of the customer’s billing address provided during the purchase process.

- Geolocation from IP address: Verification that the billing address provided, and more specifically the country, matches with the IP address country; and

- Customer Confirmation: A process to require the customer to confirm the accuracy of the provided address when the country of the IP address does not match the billing address provided, which may involve a manual confirmation step or checkbox in the checkout page.

That is exactly what our add-on EU VAT Assistant for Fluid Checkout does.

Disclaimer #

These requirements are designed to ensure the accurate verification of customer details, compliance with EU regulations, and the prevention of fraudulent activities in the sale of digital goods within the EU.

The use of the information on this website and/or the use of our EU VAT Assistant add-on cannot be considered tax advice and compliance with the European Laws is entirely your responsibility. We recommend consulting a local tax professional to help you with tax compliance or if you have any tax specific questions.