Tax deduction and how to add company information at checkout #

When purchasing as a company, you may be entitled for tax deduction depending on where you company is based. You can add your company information including your TAX-ID/VAT-ID at checkout after you click the button “Proceed to pay via Paddle” on our checkout page.

Follow these steps to add your company information at checkout:

- Enter your email and name on our checkout page.

- Click the button “Proceed to pay via Paddle”.

- You’ll be redirected to another page and the Paddle payment popup will appear.

- Confirm your email and select your country.

- Click the button “Continue”.

- You’ll be prompted to enter your credit card or use PayPal for payment. At this point, the VAT-ID field will be available on the order summary section on the left part of the Paddle payment popup.

- Click the link “Add VAT” as shown on the screenshot attached.

- You’ll be prompted to enter your VAT-ID number and more details about your company, once done, the VAT charge will be deducted from the total.

- Confirm and enter your payment details.

- Click the button “Subscribe now” to complete your order.

Alternatively, you could also complete your purchasing without providing your company information and TAX-ID/VAT-ID and add it later to your invoice. Once a valid VAT-ID is added to the invoice, you’ll automatically receive a partial refund for the taxes charged. See more about this on the section “Adding billing details and VAT number to my invoice” below.

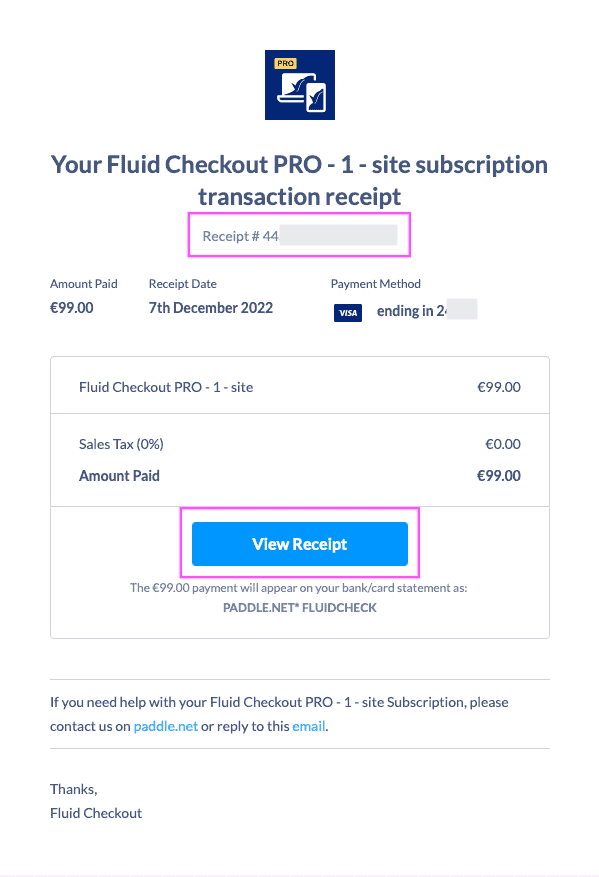

Finding an invoice or receipt #

You can find and print your invoice for the purchases on Fluid Checkout by clicking the option “View receipt” on the order confirmation email sent by Paddle (our payments partner).

The email from Paddle usually has a subject similar to “Your Fluid Checkout <product_purchased> subscription transaction receipt”.

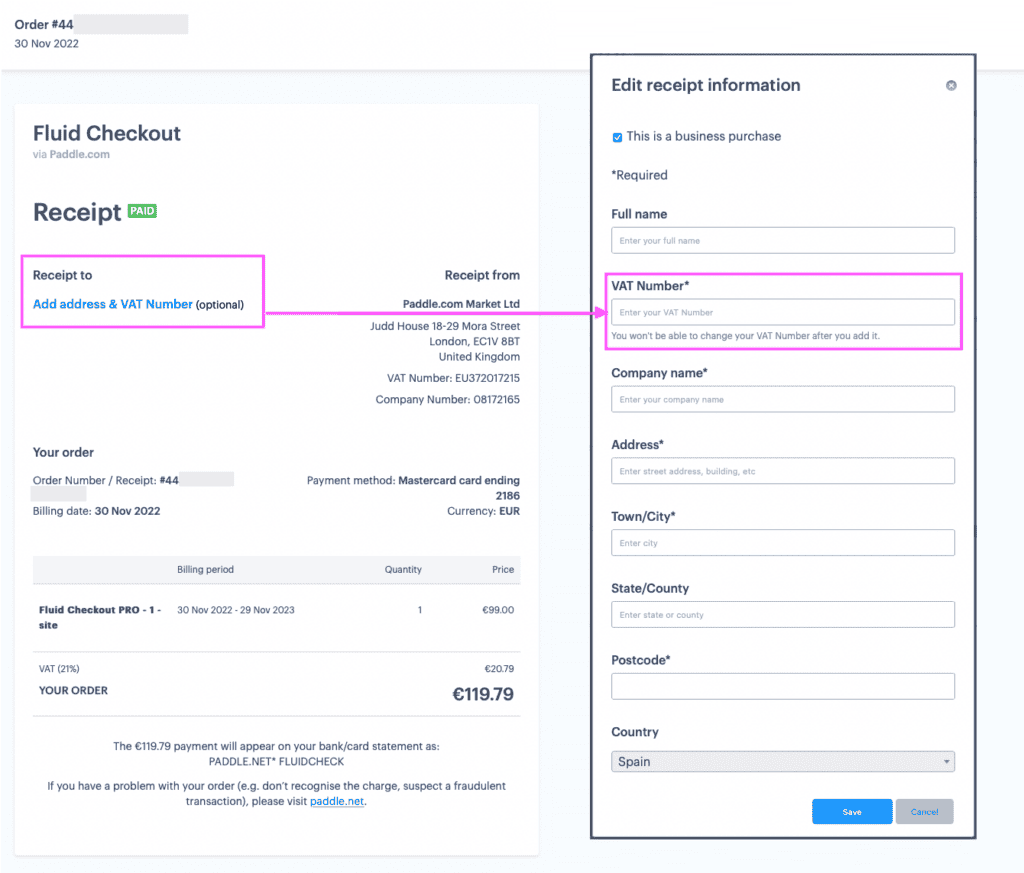

Adding billing details and VAT number to my invoice #

Once you open your invoice in your browser, you can use the option “Add address” or “Add address & VAT Number” to add the required billing details for your accounting.

- Click the option “View receipt” on the order confirmation email sent by Paddle.

- On the invoice details page, choose the option “Add address” or “Add address & VAT Number”.

- On the popup screen “Edit receipt information”, enter your details that are missing.

- Mark the option “This is a business purchase” to enter a company name and VAT Number or other relevant sales tax number (optional).

- Enter your VAT number (optional). Double check your VAT number entered as you won’t be able to change it after it is saved.

- Enter your address information.

- Choose the option “Save” at the bottom right on the popup screen.

Issues with invoices and requesting a refund for sales tax (VAT) #

If you have any issues regarding your invoice, or in case you believe that you have been incorrectly charged for Sales Tax (VAT), contact the Paddle support team directly. Paddle will review your information provided and make any necessary adjustments.

When contacting Paddle, provide your invoice/receipt number as seen on the order confirmation email that was sent by Paddle. See section Finding an invoice or receipt.